Corporation Tax Exemption Not For Profit . Taxable income is income that is. A basic guide to learn about corporate income tax in singapore e.g. Learn more about the requirements an npo must fulfill. Tax rates, year of assessment, filing obligations, and tips for new companies. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Singapore’s corporate income tax rate is 17%. Income derived by companies in singapore is taxed at a flat rate of 17%. Income & deductions for companies. Companies may enjoy tax rebates and tax exemption schemes e.g.

from www.scribd.com

Singapore’s corporate income tax rate is 17%. Companies may enjoy tax rebates and tax exemption schemes e.g. Taxable income is income that is. Income & deductions for companies. Income derived by companies in singapore is taxed at a flat rate of 17%. Tax rates, year of assessment, filing obligations, and tips for new companies. A basic guide to learn about corporate income tax in singapore e.g. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Learn more about the requirements an npo must fulfill.

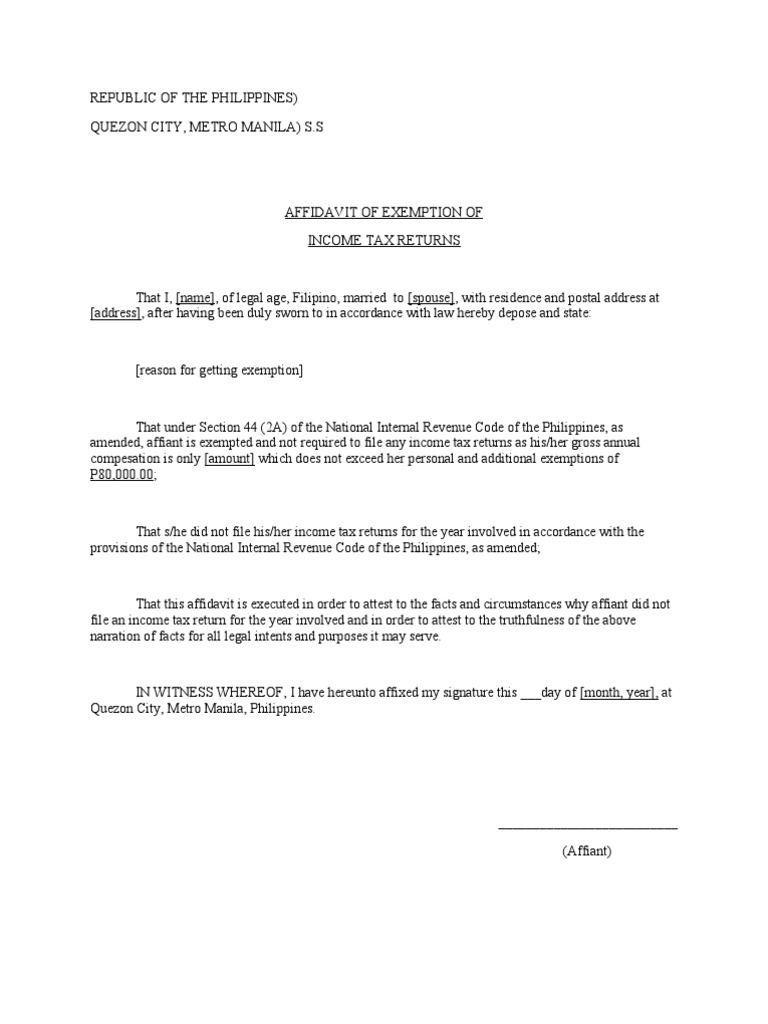

Affidavit of Tax Exemption Template.doc

Corporation Tax Exemption Not For Profit Income & deductions for companies. Taxable income is income that is. Income & deductions for companies. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; A basic guide to learn about corporate income tax in singapore e.g. Learn more about the requirements an npo must fulfill. Companies may enjoy tax rebates and tax exemption schemes e.g. Income derived by companies in singapore is taxed at a flat rate of 17%. Singapore’s corporate income tax rate is 17%. Tax rates, year of assessment, filing obligations, and tips for new companies.

From www.exemptform.com

Virginia Sales Tax Exemption Form For Non Profit Corporation Tax Exemption Not For Profit Income derived by companies in singapore is taxed at a flat rate of 17%. Learn more about the requirements an npo must fulfill. A basic guide to learn about corporate income tax in singapore e.g. Tax rates, year of assessment, filing obligations, and tips for new companies. Income & deductions for companies. Singapore’s corporate income tax rate is 17%. Section. Corporation Tax Exemption Not For Profit.

From ericperkinslaw.com

TaxExempt vs. Nonprofit in Virginia Perkins Law, PLLC Corporation Tax Exemption Not For Profit Taxable income is income that is. Tax rates, year of assessment, filing obligations, and tips for new companies. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Income & deductions for companies. Singapore’s corporate income tax rate is 17%. Companies may enjoy tax rebates and tax exemption schemes e.g. Learn more about the requirements. Corporation Tax Exemption Not For Profit.

From www.northwestregisteredagent.com

Nonprofit Articles of Incorporation Template Nonprofit Legal Forms Corporation Tax Exemption Not For Profit Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Taxable income is income that is. Income derived by companies in singapore is taxed at a flat rate of 17%. Learn more about the requirements an npo must fulfill. Singapore’s corporate income tax rate is 17%. Companies may enjoy tax rebates and tax exemption schemes. Corporation Tax Exemption Not For Profit.

From classfullschmaltz.z19.web.core.windows.net

Request For Tax Exemption Letter Example Corporation Tax Exemption Not For Profit Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Income & deductions for companies. Singapore’s corporate income tax rate is 17%. Taxable income is income that is. Learn more about the requirements an npo must fulfill. Tax rates, year of assessment, filing obligations, and tips for new companies. A basic guide to learn about. Corporation Tax Exemption Not For Profit.

From flpatellaw.com

NonProfit with Full 501(c)(3) Application in FL Patel Law Corporation Tax Exemption Not For Profit Income & deductions for companies. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; A basic guide to learn about corporate income tax in singapore e.g. Companies may enjoy tax rebates and tax exemption schemes e.g. Tax rates, year of assessment, filing obligations, and tips for new companies. Income derived by companies in singapore. Corporation Tax Exemption Not For Profit.

From articlesofincorporation.org

Free Maryland Articles of Incorporation TaxExempt Nonstock Corporation Corporation Tax Exemption Not For Profit Companies may enjoy tax rebates and tax exemption schemes e.g. Income & deductions for companies. Taxable income is income that is. Income derived by companies in singapore is taxed at a flat rate of 17%. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Learn more about the requirements an npo must fulfill. A. Corporation Tax Exemption Not For Profit.

From www.reddit.com

W9 Exemption Codes Question LLC Taxed as SCorp r/tax Corporation Tax Exemption Not For Profit Taxable income is income that is. Tax rates, year of assessment, filing obligations, and tips for new companies. Income derived by companies in singapore is taxed at a flat rate of 17%. Companies may enjoy tax rebates and tax exemption schemes e.g. Singapore’s corporate income tax rate is 17%. Section 30 corporations include (1) labor, agriculture or horticultural organizations not. Corporation Tax Exemption Not For Profit.

From www.investopedia.com

Do Nonprofit Organizations Pay Taxes? Corporation Tax Exemption Not For Profit Taxable income is income that is. A basic guide to learn about corporate income tax in singapore e.g. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Singapore’s corporate income tax rate is 17%. Income & deductions for companies. Companies may enjoy tax rebates and tax exemption schemes e.g. Tax rates, year of assessment,. Corporation Tax Exemption Not For Profit.

From pafpi.org

Certificate of TAX Exemption PAFPI Corporation Tax Exemption Not For Profit Income & deductions for companies. A basic guide to learn about corporate income tax in singapore e.g. Companies may enjoy tax rebates and tax exemption schemes e.g. Taxable income is income that is. Income derived by companies in singapore is taxed at a flat rate of 17%. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally. Corporation Tax Exemption Not For Profit.

From www.kff.org

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was About Corporation Tax Exemption Not For Profit Taxable income is income that is. A basic guide to learn about corporate income tax in singapore e.g. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Companies may enjoy tax rebates and tax exemption schemes e.g. Income & deductions for companies. Learn more about the requirements an npo must fulfill. Income derived by. Corporation Tax Exemption Not For Profit.

From www.rgcocpa.com

What Is The Difference Between NonProfit And TaxExempt? Rivero Corporation Tax Exemption Not For Profit Taxable income is income that is. A basic guide to learn about corporate income tax in singapore e.g. Singapore’s corporate income tax rate is 17%. Income & deductions for companies. Companies may enjoy tax rebates and tax exemption schemes e.g. Tax rates, year of assessment, filing obligations, and tips for new companies. Income derived by companies in singapore is taxed. Corporation Tax Exemption Not For Profit.

From www.fivemilehouse.org

Illinois Tax Exempt Certificate — Five Mile House Corporation Tax Exemption Not For Profit Tax rates, year of assessment, filing obligations, and tips for new companies. Taxable income is income that is. Income & deductions for companies. Singapore’s corporate income tax rate is 17%. Companies may enjoy tax rebates and tax exemption schemes e.g. Income derived by companies in singapore is taxed at a flat rate of 17%. A basic guide to learn about. Corporation Tax Exemption Not For Profit.

From www.scribd.com

Tax Exempt Form PDF Fundraising Nonprofit Organization Corporation Tax Exemption Not For Profit Companies may enjoy tax rebates and tax exemption schemes e.g. A basic guide to learn about corporate income tax in singapore e.g. Income & deductions for companies. Learn more about the requirements an npo must fulfill. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Taxable income is income that is. Income derived by. Corporation Tax Exemption Not For Profit.

From nonprofitlaw.proskauer.com

New Legislation Modernizes New York NotForProfit Corporation Law Corporation Tax Exemption Not For Profit A basic guide to learn about corporate income tax in singapore e.g. Companies may enjoy tax rebates and tax exemption schemes e.g. Tax rates, year of assessment, filing obligations, and tips for new companies. Taxable income is income that is. Income derived by companies in singapore is taxed at a flat rate of 17%. Income & deductions for companies. Singapore’s. Corporation Tax Exemption Not For Profit.

From www.studocu.com

Tax Exemption Requirements and Process Certificate of Tax Exemption Corporation Tax Exemption Not For Profit Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Income & deductions for companies. Companies may enjoy tax rebates and tax exemption schemes e.g. Taxable income is income that is. A basic guide to learn about corporate income tax in singapore e.g. Learn more about the requirements an npo must fulfill. Singapore’s corporate income. Corporation Tax Exemption Not For Profit.

From www.eztexting.com

What's the Difference Between Nonprofit vs NotforProfit? EZ Texting Corporation Tax Exemption Not For Profit Income & deductions for companies. Tax rates, year of assessment, filing obligations, and tips for new companies. Companies may enjoy tax rebates and tax exemption schemes e.g. A basic guide to learn about corporate income tax in singapore e.g. Income derived by companies in singapore is taxed at a flat rate of 17%. Learn more about the requirements an npo. Corporation Tax Exemption Not For Profit.

From www.exemptform.com

Fillable Cert 119 Connecticut Tax Exempt Form Printable Pdf Download Corporation Tax Exemption Not For Profit Income & deductions for companies. Income derived by companies in singapore is taxed at a flat rate of 17%. Section 30 corporations include (1) labor, agriculture or horticultural organizations not organized principally for profit; Tax rates, year of assessment, filing obligations, and tips for new companies. Singapore’s corporate income tax rate is 17%. A basic guide to learn about corporate. Corporation Tax Exemption Not For Profit.

From www.slideserve.com

PPT NonProfit & Tax Exempt Entities Tax and Regulatory Issues Corporation Tax Exemption Not For Profit Taxable income is income that is. Singapore’s corporate income tax rate is 17%. Tax rates, year of assessment, filing obligations, and tips for new companies. Companies may enjoy tax rebates and tax exemption schemes e.g. A basic guide to learn about corporate income tax in singapore e.g. Income & deductions for companies. Income derived by companies in singapore is taxed. Corporation Tax Exemption Not For Profit.